We are the worlds leading Data Provider

- 840, Harekrishna Vihar, Indore, India

- [email protected]

![[object Object]](/assets/img/hero/hero-shape-6.1.png)

Secure your Banking & Finance operations with High-Quality Data Solutions

We provide high-quality data services for various applications of Banking & Finance AI, including fraud detection, credit scoring, customer segmentation, investment management, and more. Our data annotation and collection services help financial institutions in training and improving their AI models for better decision-making, risk assessment, and customer satisfaction. We ensure the accuracy, consistency, and security of data to comply with regulatory standards and industry best practices. Our expertise in handling large volumes of financial data enables us to deliver customized data solutions tailored to the specific needs of our clients.

Data Solutions for AI in Banking & Finance

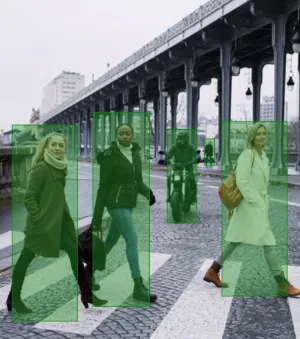

Fraud Detection & Prevention

With the help of machine learning and AI algorithms, banks and financial institutions can detect and prevent fraudulent activities. To develop such algorithms, high-quality data is required for training. Our data annotation services can help in creating labeled datasets that include credit card transactions, customer information, and other relevant data.

Customer Service

Banks and financial institutions can use AI-powered chatbots to provide personalized customer service. To develop such chatbots, high-quality data is required for training. Our data annotation services can help in creating labeled datasets that include customer queries, responses, and other relevant data.

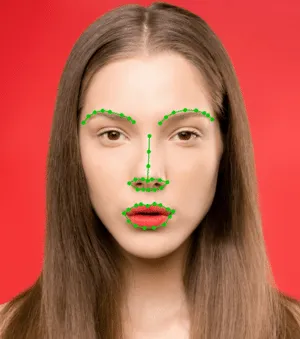

Automated KYC

We provide data collection and annotation services that include facial recognition, document recognition, and biometric identification to create a robust database of customer information. Our annotated data is then used to train machine learning algorithms that can automate the KYC process by accurately identifying customers, verifying their identities, and flagging any potential risk factors. This reduces the time and cost associated with manual verification processes while improving the overall accuracy and efficiency of the onboarding process.

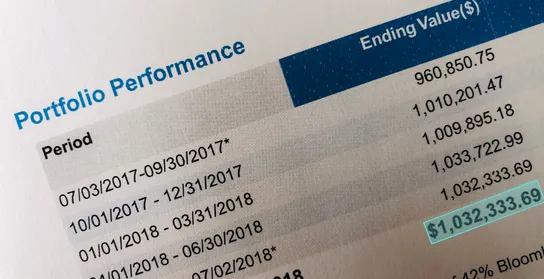

Investment and Portfolio Management

AI-powered algorithms can be used to make investment decisions and manage portfolios. To develop such algorithms, high-quality data is required for training. Our data annotation services can help in creating labeled datasets that include financial data, market trends, and other relevant data.

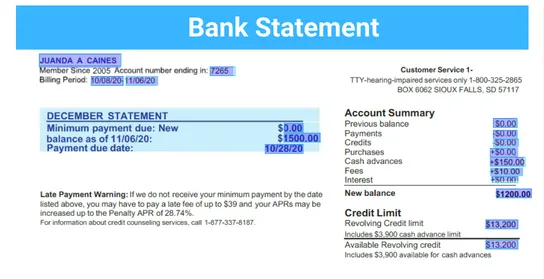

Credit Scoring

Accurate credit scoring is essential for banks and other lending institutions to minimize the risk of loan defaults. Our data annotation services can help in creating labeled datasets that include customer information, credit history, and other relevant data. These datasets can be used to train machine learning models that can accurately predict the creditworthiness of potential borrowers.

Types of Annotation

With Tagx, your AI applications will recognize and identify objects at unmatched speed, improving your models predictions and confidence levels. We understand that different AI use cases require different types of data annotation to achieve optimal performance. TagX offers a wide range of annotation services for image, text, audio, and video data, as well as 3D point cloud and LiDAR annotation. We pride ourselves on delivering high-quality annotations with precision and accuracy to ensure that your AI models can perform at their best. Whatever your use case may be, you can count on us to provide the right type of annotation to meet your specific needs.

Bounding Box Annotation

Polygon Annotation

Polyline Annotation

3D Cuboids

Semantic Segmentation

Point Annotation

Video Annotation

Have a usecase or data requirement?

Book a free consultation call today with one our Experts and explore endless possibilities.